Saudi Arabia-China economic relations thrive as international model, reflecting strong trade volume and diverse partnership opportunities: chamber head

Editor's note: Saudi Arabia, as one of the earliest countries to participate in the joint construction of the China-proposed Belt and Road Initiative (BRI), has demonstrated a strategic alignment with its own Vision 2030. This synchronization has injected significant momentum into the economic and trade development of the two countries. The robust economic complementarity between the two countries creates vast opportunities for collaborative fields, ranging from energy and transportation to finance and technology. In a recent exclusive interview with Global Times (GT) reporter Yin Yeping, Mohammed A. Al Ajlan (Al Ajlan), chairman of Saudi Chinese Business Council, highlighted the fruitful results of bilateral cooperation and expressed optimism for stronger economic ties.

GT: Saudi Arabia was an early supporter of the BRI. How has Saudi businesses benefited from the participation, and what are your expectations for future bilateral cooperation in the joint construction of this initiative?

Al Ajlan: There are great opportunities for economic integration between the Kingdom and China through the "Silk Road Economic Belt," which in many aspects is consistent with Vision 2030 in terms of its directions to exploit the Kingdom's strategic location to connect the continents of the world and make it a global logistics center.

This harmony and alignment between Vision 2030 and the BRI enhances opportunities for cooperation and partnership between the two countries, helps accelerate the pace of development and its sustainability, and provides Saudi and Chinese companies with huge investment opportunities.

Chinese investments in infrastructure in the Kingdom, represented by the BRI, are estimated at about $5.5 billion. In general, Saudi and Chinese companies have benefited and will benefit in the future from the huge investment opportunities presented by both Vision 2030 and the China-proposed BRI.

GT: Since 2013, China has become Saudi Arabia's largest trading partner, while Saudi Arabia has consistently been China's top trading partner in the Middle East for over 20 years. In what specific areas do you see the strongest complementarity between the two countries, and how can they enhance cooperation in these areas?

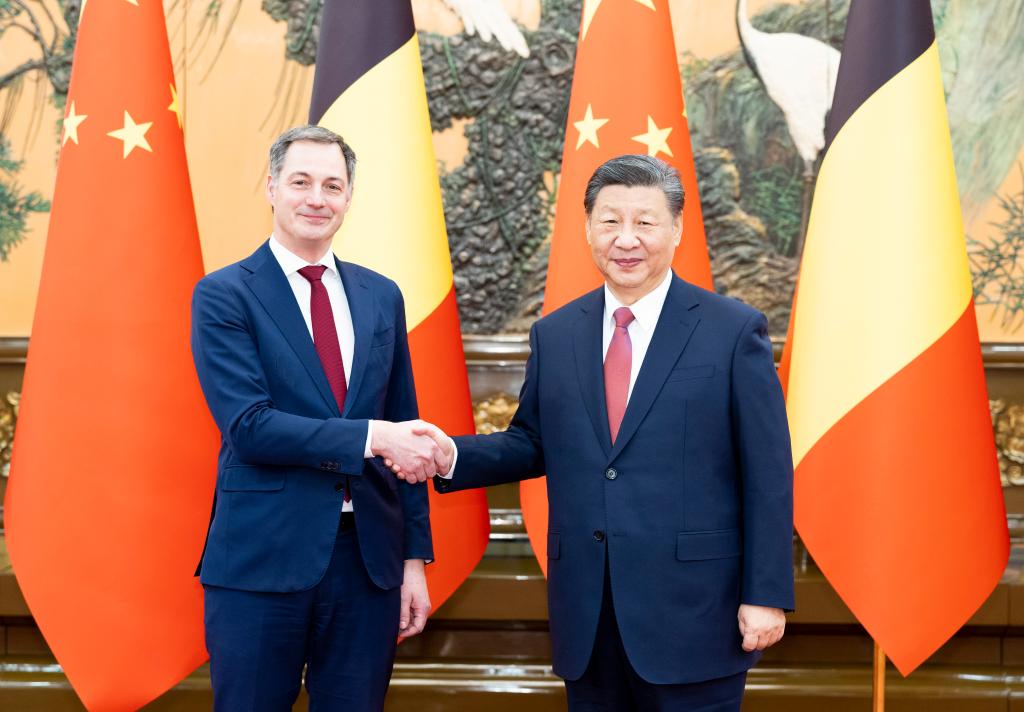

Al Ajlan: There is no doubt that the Saudi Arabia-China economic relations are strong and solid and are considered an international model to be emulated in fruitful, constructive cooperation and strategic partnership as a result of the support of the political leadership and government agencies in the two countries.

Given the volume of trade exchanges between the Kingdom and China, which amounted to about 397 billion riyals ($106 billion) in 2022, this reflects the strength of the strategic economic partnership and the diversity and multiplicity of trade and investment opportunities in the two countries.

Therefore, the areas of cooperation are open and multiple in sectors such as retail, technology, and the automobile industry, of which China holds a share of the Saudi market, in addition to energy, contracting, real estate, modern construction technology, smart cities, industry, and transportation.

Also, among the new investment areas between the two countries are the sectors such as renewable and clean energy, financial technology (fintech), tourism, entertainment, sports, and housing.

This steady development in the economic relations between the two countries came with the support of the political leadership in the Kingdom and China and this relationship is based on solid institutional frameworks such as the Saudi-Chinese Joint Committee, the Comprehensive Strategic Partnership Agreement, and bilateral cooperation agreements.

The Saudi-Chinese Business Council, which includes from the Saudi side about 350 companies, plays a great role in promoting bilateral trade, contributing directly to raising the level of trade exchanges and joint investments between the Kingdom and China.

GT: The People's Bank of China and the Saudi Central Bank signed a bilateral currency swap agreement in November 2023. What practical benefits do you anticipate from this agreement in terms of strengthening financial cooperation, trade, and investment facilitation?

Al Ajlan: This is an additional option that gives importers and exporters more flexibility and freedom to choose the currency they wish to deal in.

There is no doubt that it demonstrates the extent of the interconnected relationship between the two countries and also facilitates the process of trade exchanges.

We do not negate here the importance of being subject to the regulations of the central banks in the two countries and the requirements and regulations according to which they operate.

GT: Energy cooperation is a major focus for the two countries. In your opinion, what additional paths can be explored in energy cooperation between China and Saudi Arabia, considering the dominance of conventional fossil fuels and the emerging trends in new-energy sources?

Al Ajlan: The Kingdom today has strong strategies and directions toward transitioning to a green economy and renewable and clean energy, and as China is considered the leading country in the global new-energy sector, the opportunities for developing investment and partnership in this field are promising between the two countries.

Chinese companies are among the largest companies in the world that manufacture solar modules, and indeed there is existing cooperation and multiple agreements between Saudi and Chinese companies in renewable energy projects, solar energy, and green hydrogen.

In the traditional sector, the Kingdom is the main supplier of oil to China, and cooperation between the two countries is great in this sector, including petrochemicals.

Recently, Aramco signed several cooperation agreements with Chinese companies such as Rongsheng and Eastern Xinghong.